Judgment and Decision Making, vol. 1, no. 1, July 2006, pp. 1-12.

Biases in casino betting: The hot hand and the gambler's fallacy

James Sundali1

Managerial Sciences

University of Nevada, Reno,

Rachel Croson

Operations and Information Management

Wharton School

University of Pennsylvania

Abstract

We examine two departures of individual perceptions of

randomness from probability theory: the hot hand and the

gambler's fallacy, and their respective opposites. This

paper's first contribution is to use data from the field

(individuals playing roulette in a casino) to demonstrate the

existence and impact of these biases that have been previously

documented in the lab. Decisions in the field are consistent

with biased beliefs, although we observe significant individual

heterogeneity in the population. A second contribution is to

separately identify these biases within a given individual,

then to examine their within-person correlation. We find a

positive and significant correlation across individuals between

hot hand and gambler's fallacy biases, suggesting a common

(root) cause of the two related errors. We speculate as to the

source of this correlation (locus of control), and suggest

future research which could test this speculation.

Keywords: judgment and decision making, hot hand, gambler's fallacy,

casino betting, field data, roulette

1 Introduction

Almost every decision we make involves uncertainty in some way. Yet

research on decision making under uncertainty demonstrates that our

judgments are often not consistent with probability theory. Intuitive

ideas of randomness depart systematically from the laws of chance.

This research suggests that we have developed a number of judgment

heuristics for analyzing complex, real-world events. Although many

decisions based on these heuristics are consistent with probability

theory, there are also situations where heuristics lead to statistical

illusions and suboptimal actions.

This paper investigates the existence and impact of two of these

statistical illusions; the gambler's fallacy and the

hot hand. Both of these illusions characterize individuals'

perceptions of non-autocorrelated random sequences. Thus both involve

perceptions of sequences of events rather than one-time events.

The gambler's fallacy is a belief in negative autocorrelation of a

non-autocorrelated random sequence of outcomes like coin flips. For

example, imagine Jim repeatedly flipping a (fair) coin and guessing the

outcome before it lands. If he believes in the gambler's fallacy, then

after observing three heads in a row, his subjective probability of

seeing another head is less than 50%. Thus he believes a tail is

"due," and is more likely to appear on the next flip than a head.

In contrast, the hot hand is a belief in positive autocorrelation of a

non-autocorrelated random sequence of outcomes like winning or losing.

For example, imagine Rachel repeatedly flipping a (fair) coin and

guessing the outcome before it lands. If she believes in the hot hand,

then after observing three correct guesses in a row her subjective

probability of guessing correctly on the next flip is higher than 50%.

Thus she believes that she is "hot" and more likely than chance to

guess correctly.

Notice that these two biases are not simply opposites. The gambler's

fallacy describes beliefs about outcomes of the random process

(e.g., heads or tails), while the hot hand describes beliefs of outcomes

of the individual (like wins and losses). In the gambler's

fallacy, the coin is due; in the hot hand the person

is hot. For purposes of our study, we will identify four possible

biases that individuals could exhibit. The gambler's fallacy and its

opposite, the hot outcome, are beliefs about the coin's outcomes

involving negative versus positive autocorrelation of random outcomes.

The hot hand and its opposite, the stock of luck, are beliefs about the

individual's success involving positive versus negative autocorrelation

of winning or losing.

Thus someone can believe both in the gambler's fallacy (that after three

coin flips of heads tails is due) and the hot hand (that after three

wins they will be more likely to correctly guess the next outcome of

the coin toss). These biases are believed to stem from the same

source, the representativeness heuristic, as discussed below

(Gilovich, Vallone and Tversky 1985).

In this paper we use empirical data from gamblers in casinos to examine

the existence, prevalence and correlation between gambler's fallacy and

hot hand beliefs. A companion paper, Croson and Sundali (2005) uses the

same data to examine the aggregate (market) impact of these biases. In

contrast, here we will identify the biases at the individual level, and

examine the within-participant correlation between the two.

Empirical data, while difficult to obtain and to code, can provide an

important complement and robustness check on other methods in

investigating biases. Participants in the casinos are making real

decisions with their own money on the line. Further, the participants

represent a more motivated sample than typical students at a

university; gamblers have a very real incentive to learn the game they

are playing and to make decisions in accordance with their beliefs.

The use of casino data does, however, involve some limitations.

In particular, we were prevented from directly contacting the

gamblers in the study, thus we cannot ask particular individuals

why they bet how they did or about their beliefs at the time of

placing the bet. Also, the gambling population, while motivated,

is a selected subsample of the population at large. Thus we will

have to be cautious in our claims of external validity from this

study. Nonetheless, we believe that the demonstration of these

biases in the field at the level of the individual is an

important contribution in and of itself. We are also one of the

very few papers to identify multiple biases within an individual

and to characterize the correlation between them.

1.1 Definitions and previous research

1.1.1 Gambler's fallacy

The gambler's fallacy is defined as an (incorrect) belief in

negative autocorrelation of a non-autocorrelated random

sequence.2 For example, individuals who believe

in the gambler's fallacy believe that after three red numbers

appearing on the roulette wheel, a black number is "due," that

is, is more likely to appear than a red number.

Gambler's fallacy-type beliefs were first observed in the

laboratory (under controlled conditions) in the literature on

probability matching. In these experiments subjects were asked

to guess which of two colored lights would next illuminate.

After seeing a string of one outcome, subjects were significantly

more likely to guess the other, an effect referred to in that

literature as negative recency (see Estes, 1964, and

Lee, 1971, for reviews). Ayton and Fischer (2004) also

demonstrate the existence of gambler's fallacy beliefs in the lab

when subjects choose which of two colors will appear next on a

simulated roulette wheel. Gal and Baron (1996) show that

gambler's fallacy behavior is not simply caused by boredom;

participants in their experiments were asked how they would best

maximize their earnings, and they responded with gambler's

fallacy type logic.

The gambler's fallacy is thought to be caused by the

representativeness heuristic (Tversky and Kahneman 1971, Kahneman

and Tversky 1972). Here, chance is perceived as "a

self-correcting process in which a deviation in one direction

induces a deviation in the opposite direction to restore the

equilibrium" (Tversky & Kahneman, 1974, p. 1125). Thus after a

sequence of three red numbers appearing on the roulette wheel,

black is more likely to occur than red because a sequence

red-red-red-black is more representative of the underlying

distribution than a sequence red-red-red-red. We test for the

gambler's fallacy in our data by looking at the impact of

previous outcomes on current bets at roulette. People who

believe in the gambler's fallacy should be less likely to bet on

a number that has previously appeared.

For purposes of this analysis, we will examine two separate

definitions of hotness, hot outcome and hot

hand. Hot outcome will simply be the opposite of the

gambler's fallacy, that is, an (incorrect) belief in positive

autocorrelation of a non-autocorrelated random

sequence.3 For example, individuals who believe in hot

outcome believe that after three red numbers appearing on the

roulette wheel, another red number is more likely to appear than

a black number because red numbers are hot. Notice that here the

outcomes are hot (e.g., red numbers), rather than

individuals, as in the hot hand, below.

In the lab, the literature on probability matching also provides

evidence favoring hot outcome beliefs. Edwards (1961), Lindman and

Edwards (1961) and Feldman (1959) all found positive recency

effects in probability matching tasks. In particularly long sequences

of the probability matching game, participants were significantly more

likely to guess the same outcome as had been observed

previously.4

We will test for hot outcome beliefs in our data by looking at

the impact of previous outcomes on current bets at roulette. If

gamblers believe in hot outcomes, they should be more likely to

bet on an outcome that has previously been observed. Thus a

positive relationship between previously-observed outcomes and

current bets is indicative of a belief in hot

outcomes.5

Hot hand is different from hot outcome. Rather than believing

that a particular outcome is hot, individuals who believe in

the hot hand believe that a particular person is hot. For

example, if an individual has won in the past, whatever

numbers they choose to bet on are likely to win in the future, not just

the numbers they've won with previously.

Gilovich, Vallone and Tversky (1985) demonstrated that

individuals believe in the hot hand in basketball shooting, and

that these beliefs are not correct (i.e., basketball shooters'

probability of success is indeed serially uncorrelated). Other

evidence from the lab shows that subjects in a simulated

blackjack game bet more after a series of wins than they do after

a series of losses, both when betting on their own play and on

the play of others (Chau & Phillips, 1995). Further evidence of

the hot hand in a laboratory experiment comes from Ayton and

Fischer (2004). Participants exhibit more confident in their

guesses of what color will next appear after a string of correct

guesses than after a string of incorrect guesses.

Explanations for the hot hand are numerous. It is clearly related to

the illusion of control (Langer, 1975), where individuals believe they

can control outcomes that are, in fact, random. Gilovich et al., (1985)

suggest that the hot hand also arises out of the representativeness

heuristic, just as the gambler's fallacy. They write

A conception of chance based on representativeness, therefore, produces

two related biases. First, it induces a belief that the probability of

heads is greater after a long sequence of tails than after a long

sequence of heads - this is the notorious gambler's fallacy (see,

e.g., Tversky and Kahneman, 1971). Second, it leads people to reject

the randomness of sequences that contain the expected number of runs

because even the occurrence of, say, four heads in a row - which is

quite likely in a sequence of 20 tosses - makes the sequence appear

nonrepresentative. (p. 296).

This second explanation is supported by data in which participants are

asked to generate strings of random numbers. The strings generated

produced significantly fewer runs of the same outcome than a truly

random sequence would (see Wagenaar 1972 for a review, for an exception

see Rapoport & Budesceu 1992).

We will test for hot hand beliefs in our data by looking at how betting

behavior changes in response to wins and losses. In particular, hot

hand beliefs predict that after winning, individuals will increase the

number of bets they place and after losing, decrease them.

Just as the gambler's fallacy and the hot outcome are opposing

biases, the hot hand has an opposing bias, referred to here as

"stock of luck" beliefs. Individuals believe they have a stock

or fixed amount of luck and, once it's spent, their probability

of winning decreases. Thus after a string of wins, individuals

are less likely to win (rather than more likely as predicted by

the hot hand) because they have exhausted their stock of luck.

The effect has been demonstrated in the lab by Leopard (1978) who

examines choice behavior in a series of gambles and demonstrates

that subjects take more risk after losing than after winning,

suggesting that their bad luck is about to change or their good

luck about to run out.6

Stock of luck beliefs predict that after winning, individuals will

decrease the number of bets they place and, after a loss, increase

them. Thus a negative relationship observed between current betting

behavior and previous wins/losses will provide evidence for

this bias.

1.2 Individual differences

A large literature identifies individual differences in risk

attitudes (e.g., Weber et al.,1992; Blais & Weber, 2006; Harris

et al., 2006). In addition, previous work has identified

individual heterogeneity in biased beliefs about sequences of

gambles. Friedland (1988) uses a personality inventory to

categorize individuals into luck-oriented and chance-oriented.

In a questionnaire design, he finds gamblers' fallacy behavior in

luck-oriented individuals but no such behavior, and in

particular, no dependence of current bets on past outcomes, in

chance-oriented individuals.

In the field, previous work has also found individual heterogeneity in

biased beliefs. Keren and Wagenaar (1985) examine blackjack play of 47

individuals who played at least 75 hands and changed their bets over

time. Of these, 25 had relationships between previous outcomes and bet

changes (thus, exhibiting a bias of some sort). Fourteen of them

increased their bets after they won and decreased them after they lost

(consistent with the hot hand), while 11 decreased their bets after

winning and increased them after losing (consistent with stock of

luck). As in these studies, we will use our data to analyze individual

differences in betting behavior.

Only two previous papers examine field behavior at roulette. The

first is an observational sociological field study by Oldman

(1974) which informally reports both the gambler's fallacy and

the hot outcome. He writes that "[t]he bet on a particular spin

tends to be placed on outcomes that are `due' either because they

have not occurred for some time or because that is the way

`things are running."' (p. 418). The second source, Wagenaar

(1988, Ch. 4), discusses data from 29 roulette players in a

casino who stayed between 1 and 18 spins each. Of the 11 players

who varied their bets most, he finds after a win 39% of bets

involve increased risk (hot hand) and 61% involve decreased risk

(stock of luck). After a loss, 43% of bets involve decreased

risk (hot hand) and 57% of bets do not (stock of luck).

However, Wagenaar does not present an analysis of how individuals

differ on this dimension.

While previous papers have investigated the gambler's fallacy and hot

hand biases, our work makes two important and original contributions.

First, it provides a field setting in which it is possible to

investigate both biases at once. These biases have been analyzed

together only in the lab (Ayton and Fischer 2004). Second, our

empirical data will allow us to identify individual differences in

these biases. We will be able to examine the correlation between these

biases within the individual.7

1.3 Field data

In this study we use observational data from the field; individuals

betting at roulette in a casino. Roulette is a useful game for a

number of reasons. First, it is serially uncorrelated, unlike other

casino games like blackjack or baccarat where cards are dealt without

replacement. Second, each player has his or her own colored chips,

thus tracking an individual's betting behavior is feasible. Finally,

roulette is an extremely popular and accessible game which requires

relatively little skill to play (unlike craps, for example, which is

perceived as a game for experts). Thus roulette is likely to suffer

from less selection bias than craps, although we are already selecting

participants from the casino gambling population, mentioned above as an

unavoidable selection bias.

Roulette involves a dealer (sometimes two), a wheel and a layout. The

wheel is divided into 38 even sectors, numbered 1-36, plus 0 and 00.

Each space is red or black, with the 0 and 00 colored green. The wheel

is arranged as shown in Figure 1, such that red and black numbers

alternate.

Figure 1: The wheel

Players arrive at the roulette table and offer the dealer money (either

cash or casino chips). In exchange, they are given special roulette

chips for betting at this wheel. These chips are not valid anywhere

else in the casino, and each player at the table has a unique color of

chips. Players bet by placing chips on a numbered layout, the wheel is

spun and a small white ball rolled around its edge. The ball lands on

a particular number in the wheel, which is the winning number for that

round, and is announced publicly by the dealer. Next, the dealer

clears away all losing bets, players who had bet on the winning number

(in some configuration) are paid in their own-colored chips and a new

round of betting begins.

Figure 2 shows a typical layout, along with the types of bets that can

be made. Unlike the wheel, the layout is arranged in numerical order.

Players can place their bets on varying places on the layout. Bets of

the type on the number 30 are called "straight up" bets. These are

bets on a single number. If the number comes up on the wheel, this bet

would pay the player 36 for 1 (35 to 1). That is, when 1 chip is bet,

the dealer pays the player 35 chips directly, and the chip that was bet

is not removed from the table. Bets of the type between the 8 and 11,

"line bets" are bets on two numbers. If either of the numbers comes

up, this bet pays the player 18 for 1. Players can also bet on

combinations of 3 numbers (by the 13) which pay 12 for 1, combinations

of 4 numbers (on the corner of 17-18-20-21) which pay 9 for 1, or

combinations of 6 numbers (by the 22-25) which pay 6 for 1. Players

can, of course, bet on "outside" bets like red/black, even/odd and

low/high. These bets will not be included in our analysis, as they are

not bet often enough to allow identification at the individual level,

but are discussed in our companion paper on aggregate behavior, Croson

and Sundali (2005).

Figure 1: The wheel

Players arrive at the roulette table and offer the dealer money (either

cash or casino chips). In exchange, they are given special roulette

chips for betting at this wheel. These chips are not valid anywhere

else in the casino, and each player at the table has a unique color of

chips. Players bet by placing chips on a numbered layout, the wheel is

spun and a small white ball rolled around its edge. The ball lands on

a particular number in the wheel, which is the winning number for that

round, and is announced publicly by the dealer. Next, the dealer

clears away all losing bets, players who had bet on the winning number

(in some configuration) are paid in their own-colored chips and a new

round of betting begins.

Figure 2 shows a typical layout, along with the types of bets that can

be made. Unlike the wheel, the layout is arranged in numerical order.

Players can place their bets on varying places on the layout. Bets of

the type on the number 30 are called "straight up" bets. These are

bets on a single number. If the number comes up on the wheel, this bet

would pay the player 36 for 1 (35 to 1). That is, when 1 chip is bet,

the dealer pays the player 35 chips directly, and the chip that was bet

is not removed from the table. Bets of the type between the 8 and 11,

"line bets" are bets on two numbers. If either of the numbers comes

up, this bet pays the player 18 for 1. Players can also bet on

combinations of 3 numbers (by the 13) which pay 12 for 1, combinations

of 4 numbers (on the corner of 17-18-20-21) which pay 9 for 1, or

combinations of 6 numbers (by the 22-25) which pay 6 for 1. Players

can, of course, bet on "outside" bets like red/black, even/odd and

low/high. These bets will not be included in our analysis, as they are

not bet often enough to allow identification at the individual level,

but are discussed in our companion paper on aggregate behavior, Croson

and Sundali (2005).

Figure 2: The layout

Notice that all these bets have the same expected value, -5.26%

on a double-zero wheel.8

Since the house advantage on (almost) all bets at the wheel is

the same, there is no economic reason to bet one way or another

(or for that matter, at all). In this paper, we will compare

actual betting behavior we observe against a benchmark of random

betting and search for systematic and significant deviations from

that benchmark.

Figure 2: The layout

Notice that all these bets have the same expected value, -5.26%

on a double-zero wheel.8

Since the house advantage on (almost) all bets at the wheel is

the same, there is no economic reason to bet one way or another

(or for that matter, at all). In this paper, we will compare

actual betting behavior we observe against a benchmark of random

betting and search for systematic and significant deviations from

that benchmark.

2 Method

The data were gathered from a large casino in Reno, Nevada, and

were also used in Croson and Sundali (2005) to examine aggregate

behavior.9 Casino executives supplied the

researchers with security videotapes for 18 hours of play of a

single roulette table. The videotapes consisted of three

separate six-hour time blocks over a 3-day period in July of

1998.10 The videotapes

provided an overhead view of the roulette area. The camera angle

was focused on the roulette layout to allow the coding of bets

placed and to protect player anonymity. Players were not

directly visible, however individual bets could be tracked by the

color of the chips being used. The videotape was subtitled with

a time counter. Note that while many casinos employ electronic

displays showing previous outcomes of the wheel, this casino had

no such displays at the time the data was collected.

A research assistant was employed to view and record player bet data

from these videotapes. Players were identified based upon the color of

the chips being used to bet, the player's location at the table, and

any distinct characteristics of the player's hand or arm such as

jewelry, clothing, tattoos, etc. Players who ran out of chips and

immediately bought more (of the same color) were coded as the same

player. Players who ran out of chips and did not immediately buy more

were coded as having left the table. When money was again exchanged

for chips of that particular color, we assumed a new player had joined

the table.11

The videotape methodology made it possible to view all of bets

made by each player with a high degree of accuracy. However,

while we could observe if a player bet on a particular

number, given the angle of the camera (from above), we could not

observe how many chips he or she bet on a particular

number. Thus we simplified the data recording to include simply

a bet being placed, without mention of how much the bet was. In

order to be consistent in not recording the amount bet, we coded

bets on multiple numbers (fractional bets like those in Figure 2)

the same as we recorded bets on single numbers. For example, a

player could place a single "corner bet" on 17, 18, 20, 21 by

placing his chip at the intersection of these numbers. We

recorded this bet as a bet placed on each of the four numbers.

We limit our analysis in this paper to bets placed in the inside

of the roulette layout, thus we do not count bets placed on

black/red, even/odd, high/low, 1,

2 or 3 12 or columns in

our data; the interested reader can find analysis of these

outside bets in aggregate in Croson and Sundali (2005). After

the assistant recorded all of the bets from the 18 hours of

videotape, one of the principal investigators performed an audit

check to insure accuracy.

3 Results

3.1 Descriptive Statistics: The Wheel and The Bets

Nine hundred and four spins of the roulette wheel were captured in this

data set (approximately 1 spin per minute). The expected frequency of

a single number on a perfectly fair roulette wheel is 1/38 or 2.6%. In

this sample the most frequent outcome was number 30 at 3.7%, the least

frequent outcome was number 26 at 1.7%. These data provide no evidence

that the wheel is biased.12 Table 1 presents the outcomes and the bets placed during

our sample.

Table 1: Spin outcomes and player bets

| | Frequency | Percent | Percent | Outcome - | Frequency | Percent |

| Outcome | outcome | outcome | expected | Expected | bet | bet |

|

0/0 | 22 | 0.024 | 0.026 | -0.002 | 354 | 0.016 |

| 0 | 25 | 0.028 | 0.026 | 0.001 | 442 | 0.020 |

| 1 | 23 | 0.025 | 0.026 | -0.001 | 362 | 0.016 |

| 2 | 30 | 0.033 | 0.026 | 0.007 | 450 | 0.020 |

| 3 | 28 | 0.031 | 0.026 | 0.005 | 357 | 0.016 |

| 4 | 15 | 0.017 | 0.026 | -0.010 | 375 | 0.017 |

| 5 | 28 | 0.031 | 0.026 | 0.005 | 636 | 0.028 |

| 6 | 20 | 0.022 | 0.026 | -0.004 | 363 | 0.016 |

| 7 | 15 | 0.017 | 0.026 | -0.010 | 682 | 0.030 |

| 8 | 26 | 0.029 | 0.026 | 0.002 | 633 | 0.028 |

| 9 | 23 | 0.025 | 0.026 | -0.001 | 503 | 0.022 |

| 10 | 24 | 0.027 | 0.026 | 0.000 | 484 | 0.021 |

| 11 | 26 | 0.029 | 0.026 | 0.002 | 783 | 0.035 |

| 12 | 21 | 0.023 | 0.026 | -0.003 | 360 | 0.016 |

| 13 | 21 | 0.023 | 0.026 | -0.003 | 525 | 0.023 |

| 14 | 27 | 0.030 | 0.026 | 0.004 | 649 | 0.029 |

| 15 | 27 | 0.030 | 0.026 | 0.004 | 340 | 0.015 |

| 16 | 25 | 0.028 | 0.026 | 0.001 | 643 | 0.029 |

| 17 | 23 | 0.025 | 0.026 | -0.001 | 1079 | 0.048 |

| 18 | 23 | 0.025 | 0.026 | -0.001 | 518 | 0.023 |

| 19 | 30 | 0.033 | 0.026 | 0.007 | 595 | 0.026 |

| 20 | 24 | 0.027 | 0.026 | 0.000 | 983 | 0.044 |

| 21 | 26 | 0.029 | 0.026 | 0.002 | 447 | 0.020 |

| 22 | 32 | 0.035 | 0.026 | 0.009 | 576 | 0.026 |

| 23 | 24 | 0.027 | 0.026 | 0.000 | 746 | 0.033 |

| 24 | 18 | 0.020 | 0.026 | -0.006 | 461 | 0.020 |

| 25 | 19 | 0.021 | 0.026 | -0.005 | 521 | 0.023 |

| 26 | 15 | 0.017 | 0.026 | -0.010 | 703 | 0.031 |

| 27 | 22 | 0.024 | 0.026 | -0.002 | 490 | 0.022 |

| 28 | 25 | 0.028 | 0.026 | 0.001 | 827 | 0.037 |

| 29 | 23 | 0.025 | 0.026 | -0.001 | 878 | 0.039 |

| 30 | 33 | 0.037 | 0.026 | 0.010 | 695 | 0.031 |

| 31 | 22 | 0.024 | 0.026 | -0.002 | 664 | 0.029 |

| 32 | 29 | 0.032 | 0.026 | 0.006 | 925 | 0.041 |

| 33 | 17 | 0.019 | 0.026 | -0.008 | 613 | 0.027 |

| 34 | 29 | 0.032 | 0.026 | 0.006 | 597 | 0.027 |

| 35 | 22 | 0.024 | 0.026 | -0.002 | 627 | 0.028 |

| 36 | 22 | 0.024 | 0.026 | -0.002 | 641 | 0.028 |

|

|

If players bet randomly, we would expect them to bet on each

number equally, thus 2.6% of the bets should fall on each

number, independently of the history of numbers which have

appeared. This independence is what we will test in our

analyses.

3.2 Gambler's fallacy vs. hot outcome

We will use a general linear model to analyze the probability of a bet

being placed on a number that has previously appeared, versus one which

has not. Our dependent variable,

Pit is binary; if a bet was placed on number i on spin t, we record a

success (1). If no bet was so placed, we record a failure (0). Thus

we will try to predict, on the basis of previous outcomes, whether a

player will bet on a particular number.

Independent variables include an intercept, a measure of the hotness of

a number, a control for the player's "favorite" numbers and a control

for leaving a bet on the table. We measure a number's hotness by

calculating a measure of how often the number i has appeared while the

player was at the table in the spins before spin t. In

particular, Hit is how many times number i has appeared

while the player was at the table before round t minus the expected

frequency of the number i appearing. This expected frequency is simply

(1-(37/38)) where (t-1) is the number of trials

observed by the player so far. This hotness measure thus calculates

the actual frequency of a number appearing minus the expected

frequency. If a number has appeared more than expected, this hotness

measure is positive, otherwise it is negative.

If players bet according to the gambler's fallacy, the probability of

their betting on a given number should be negatively related to its

hotness measure; numbers which have come up more frequently while they

were at the table are less likely to be bet on. In contrast, if

players bet according to the hot outcome, the probability of their

betting on a given number should be positively related to its hotness

measure. Notice that this hotness measure is calculated separately for

each individual in each period, based on what they have observed up to

the point of placing their bets.

Table 2: Hot outcome results by individual

| | 112 possible | 39 logistic models | 112 possible | 93 linear models |

| Coefficient | logistic models | w/o errors | linear models | w/o errors |

|

Negative Significant (GF) | 17 | 9 | 19 | 19 |

| Negative Nonsignificant (GF) | 39 | 11 | 36 | 29 |

| Positive Nonsignificant (HO) | 37 | 10 | 34 | 25 |

| Positive Significant (HO) | 19 | 9 | 23 | 20 |

|

|

The second independent variable is an attempt to control for the

baseline bets of individuals. Roulette players often bet the same

numbers consistently and repeatedly; the bets don't vary with past

outcomes. Thus, we need to control for these bets. Some players get

lucky and hit those numbers (and others don't), which could cause the

first type of players to look as though they were betting numbers which

had come up before and the second, those which hadn't. Instead, we

want to look at deviations from betting patterns as numbers

come up. Thus in the model, we include Fit, the

percentage of spins on which the player has bet on number i previously

to period t.

We expect the coefficient on this variable to be significant and

positive (if players bet on a number previously, they are more likely

to bet on it again). However, our main reason for including it is to

control for underlying personal preferences over numbers that might

bias our coefficient of interest, the hotness measure. Thus a

significant coefficient on the hotness measure measures a deviation

from the expected betting pattern of an individual, given their bets up

until now.

The final independent variable, Lit, controls for

a behavioral anomaly particular to roulette. When a bet wins, the

dealer pays the winnings directly to the player, but leaves the

winning chip on the same spot on the table. Many players are

reluctant to move this winning chip, claiming it is unlucky. If

we were to count that unmoved chip as a bet, we would bias the

results toward hot outcome, as players are often betting (by

default) on numbers that have won in the previous

round.13 We control for this behavior by including

an independent variable that equals one if an individual has bet

on a number in the previous round and it has won, and a zero

otherwise.

Thus our final model is

|

Pit = a0 + a1 Hit + a2 Fit +a3 Lit + e |

|

For each gambler we run two GLMs (one logistic and one linear). Of the

139 gamblers in our sample, not all had placed enough bets to allow us

to estimate these models either with or without errors. Table 2

categorizes the results of the coefficient on the hotness measure

(a1) for each individual using a variety of

techniques and error thresholds. Significant coefficients here

represent estimates that are significant at the 5% level using a

two-tailed test.

As Table 2 shows, we observe significant heterogeneity in the

population. Approximately half of the players in our data (depending

which model the reader prefers) can be categorized as gambler's fallacy

players; when a number has previously appeared, the probability of

their betting on it decreases. The other half of the players in our

data can be categorized as hot outcome players; when a number has

previously appeared, the probability of their betting on it increases.

One concern with this analysis, raised by an astute referee, is

that running so many regressions must result in some false

positives (or false negatives). To test for whether simple

chance is causing our results, we conducted two further analyses.

First, we looked at the underlying p-values from the regressions

in each column. If these values had been generated randomly, we

would expect them to be uniformly distributed between 0 and 1.

We compared the actual p-values to the uniform distribution using

the Kolgoromov-Smirnov test. We confidently reject the null

hypothesis that the p-values were generated by chance for each of

the four columns in Table 2 (p < .01 for all four comparisons).

Within each column, we run a similar test for the positive

significant/nonsignificant individuals, and the negative

significant/nonsignificant individuals. Again, we confidently

reject the null hypothesis that the p-values were generated by

chance for each (p < .01 for all eight comparisons).

A more discrete analysis examines the existing categorizations. If the

results were due to chance, we would expect 5% of the observations to

fall in the negative significant category, 45% in the negative

nonsignificant category, 45% in the positive nonsignificant category

and 5% in the positive significant category. We compare the actual

observations with this expected distribution using a chi-squared test.

We robustly reject the null that the p-values were observed by chance

(p < .0001 for all four columns). A similar test on only the

positive (negative) observations yields similar results

(p < .0001 for all eight comparisons).

Results from this field study are consistent with previous lab studies

demonstrating individual heterogeneity in gambler's fallacy/hot outcome

beliefs. While some gamblers cannot be classified reliably; those that

can are roughly equally split between betting in a fashion consistent

with the gambler's fallacy and the hot outcome. In the next subsection

we continue our analysis of roulette data by examining the hot hand and

stock of luck biases.

3.3 Hot hand vs. stock of luck

There is an important conceptual difference between a belief in hot

outcomes (e.g., hot numbers) and the hot hand (e.g., a hot person).

Our second set of analyses investigates whether individual's behavior

is consistent with hot hand beliefs. To do this, we analyze whether

gamblers bet on more or fewer numbers in response to previous wins and

losses. Thus, if I've won in the past, I am hot and more likely to be

(more) in the future.

We first examine the average number of bets an individual places after

winning on the previous spin and after losing on the previous spin. If

the former is greater than the latter, we say this person bets

consistently with the hot hand. If the reverse, we say this person

bets consistently with stock of luck. Of our 139 gamblers, 62 bet

consistently with the hot hand and 32 with the stock of luck bias. Of

the remaining 45 gamblers, 31 of them either only won or only lost at

the table in our sample while 14 played for only one spin of the wheel.

As a second, more formal analysis we run a general linear model for each

individual. The dependent variable is the number of bets placed on spin

t and the independent variables include an indicator variable

describing whether the individual has won or lost on spin t-1. Table 3

reports the number of subjects whose parameter value falls into each

category. Ninety-six subjects could be categorized in this way without

errors.

As with the previous analysis of the gambler's fallacy versus the

hot outcome, we find significant individual heterogeneity in the

hot hand/stock of luck biases. Here, more subjects act

consistently with the hot hand bias (which predicts a positive

relationship between previous wins and number of bets placed)

than with the stock of luck bias (which predicts a negative

relationship). Similar reliability tests as those described

above yield similar results (p < .01 for the

Kolgoromov-Smirnov tests and p < .001 for the chi-squared

tests).

Table 3: Hot hand results by individual

| | 96 linear models |

| Coefficient | without errors |

|

Negative Significant (SL) | 6 |

| Negative Nonsignificant (SL) | 37 |

| Positive Nonsignificant (HH) | 41 |

| Positive Significant (HH) | 12 |

|

|

3.4 Correlation of Biases

Our data allow us to independently characterize individuals as gambler's

fallacy/hot outcome players and as hot hand/stock of luck players. A

further analysis examines the distribution of players over those four

types. Table 4 presents this distribution, categorizing players based

on the general linear models at the individual level reported in Table

2 (the final column) and Table 3 including those categorized as

directional.14 We

exclude 11 players who are categorized on one dimension and not on

another.

Table 4: Relationship between the biases

| | Hot outcome | Gambler's fallacy |

|

Hot Hand | 10 | 42 |

| Stock-of-Luck | 32 | 5 |

|

|

A chi-squared test strongly rejects the null hypothesis of no

relationship between the biases (p < .0001). In particular,

there appears to be a correlation; players who act consistently with

the gambler's fallacy (betting on numbers that haven't appeared

previously), are more likely to act consistently with the hot hand

(increasing the number of bets they place after a win). Almost half

the subjects are in this first category, consistent with previous

research demonstrating both biases in the lab. In contrast, players

who act consistently with the hot outcome (betting on numbers that have

appeared previously), are more likely to act consistently with the

stock-of-luck bias (decreasing the number of bets they place after a

win).

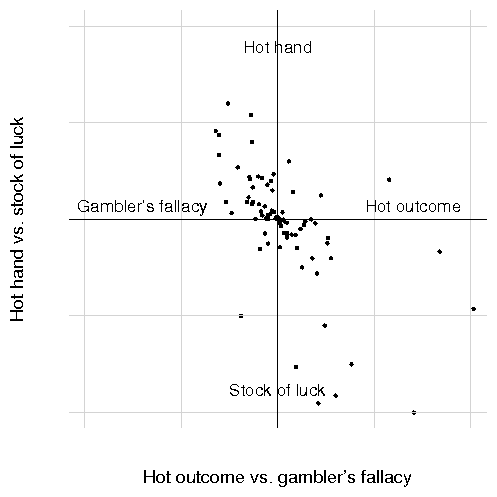

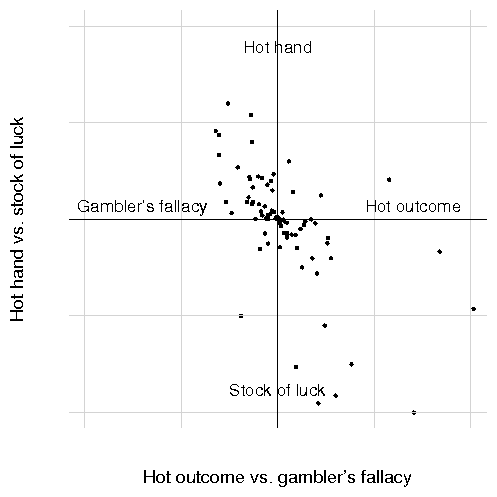

This relationship can be seen in Figure 3, below. Here we graph, for

each of the 89 individuals characterized in Table 5, their regression

parameters on the two biases.

Figure 3: Relationship between biases

What accounts for the pattern of individual beliefs found in

Figure 3? While further research will be necessary to flesh out

the variables underlying these patterns, we propose locus of

control as an organizing explanation for this pattern.

Originally developed by Rotter (1964), Zimbardo (1985) defines

locus of control as: "... a belief about whether the outcomes

of our actions are contingent on what we do (internal locus of

control) or on events outside our personal control (external

control orientation)" (p. 275).

Generally a person with an internal locus of control attributes outcomes

to personal decisions and efforts while a person with an external locus

of control attributes outcomes to chance or other external factors.

Applying this concept to roulette, a person with an internal locus of

control is likely to attribute previous wins to the decisions he made

and thus to connect such winning with gambling skill. If a player has

just won because of skill, then these skills should lead to more

winning, which explains why players with such beliefs increase their

bets after winning, exhibiting hot hand behavior. On the other hand, a

person with an external locus of control attributes winning to simply

luck. Thus a person with external locus of control concludes that

winning again after a previous win is less likely and will decrease

their bets after winning, exhibiting stock of luck behavior.

Remember that while the hot hand/stock of luck describes beliefs of

outcomes of the individual (like wins and losses), the gambler's

fallacy/hot outcome describes beliefs about outcomes of the random

process (like heads or tails). So how would the beliefs of a person

with an internal or external locus of control differ regarding random

processes?

Consider first the person who has an external locus of control

and thus attributes outcomes to luck (stock of luck). If one

believes luck is in control of a random process and three heads

in a row have appeared, then one should believe that luck will

continue to control the outcomes and that another head will

appear. Put another way, players who believe in luck are more

likely to believe in streaks (hot outcomes) because luck produces

streaks. Thus the external locus of control causes both stock of

luck and hot outcome beliefs.

In contrast, a person with an internal locus of control who believes

that winning is a result of skill is likely to reject the idea that the

process producing the outcomes is random since this would mitigate the

skill involved. A more plausible belief is that outcomes on the

roulette wheel are controlled by some process that can be learned or

discerned by the use of skill. When the internal person wins, it is

confirmation that she has ascertained the pattern and this confidence

leads her to bet more on the next spin of the wheel (hot hand). The

most plausible cognitive explanation for her supposed pattern-detecting

skill is representativeness, which explains why she bets consistently

with the gambler's fallacy. Thus the internal locus of control causes

both hot hand and gambler's fallacy beliefs.

Unfortunately we could not collect locus of control or other personality

measures from our casino patrons, and thus cannot test our speculation

of the underlying causes of the relationship between these two biases.

Further lab testing will be necessary to address this question, and to

compare this speculation with other candidate explanations for our

results.

Figure 3: Relationship between biases

What accounts for the pattern of individual beliefs found in

Figure 3? While further research will be necessary to flesh out

the variables underlying these patterns, we propose locus of

control as an organizing explanation for this pattern.

Originally developed by Rotter (1964), Zimbardo (1985) defines

locus of control as: "... a belief about whether the outcomes

of our actions are contingent on what we do (internal locus of

control) or on events outside our personal control (external

control orientation)" (p. 275).

Generally a person with an internal locus of control attributes outcomes

to personal decisions and efforts while a person with an external locus

of control attributes outcomes to chance or other external factors.

Applying this concept to roulette, a person with an internal locus of

control is likely to attribute previous wins to the decisions he made

and thus to connect such winning with gambling skill. If a player has

just won because of skill, then these skills should lead to more

winning, which explains why players with such beliefs increase their

bets after winning, exhibiting hot hand behavior. On the other hand, a

person with an external locus of control attributes winning to simply

luck. Thus a person with external locus of control concludes that

winning again after a previous win is less likely and will decrease

their bets after winning, exhibiting stock of luck behavior.

Remember that while the hot hand/stock of luck describes beliefs of

outcomes of the individual (like wins and losses), the gambler's

fallacy/hot outcome describes beliefs about outcomes of the random

process (like heads or tails). So how would the beliefs of a person

with an internal or external locus of control differ regarding random

processes?

Consider first the person who has an external locus of control

and thus attributes outcomes to luck (stock of luck). If one

believes luck is in control of a random process and three heads

in a row have appeared, then one should believe that luck will

continue to control the outcomes and that another head will

appear. Put another way, players who believe in luck are more

likely to believe in streaks (hot outcomes) because luck produces

streaks. Thus the external locus of control causes both stock of

luck and hot outcome beliefs.

In contrast, a person with an internal locus of control who believes

that winning is a result of skill is likely to reject the idea that the

process producing the outcomes is random since this would mitigate the

skill involved. A more plausible belief is that outcomes on the

roulette wheel are controlled by some process that can be learned or

discerned by the use of skill. When the internal person wins, it is

confirmation that she has ascertained the pattern and this confidence

leads her to bet more on the next spin of the wheel (hot hand). The

most plausible cognitive explanation for her supposed pattern-detecting

skill is representativeness, which explains why she bets consistently

with the gambler's fallacy. Thus the internal locus of control causes

both hot hand and gambler's fallacy beliefs.

Unfortunately we could not collect locus of control or other personality

measures from our casino patrons, and thus cannot test our speculation

of the underlying causes of the relationship between these two biases.

Further lab testing will be necessary to address this question, and to

compare this speculation with other candidate explanations for our

results.

4 Conclusions and discussion

This paper uses observational data to demonstrate the existence and

impact of the hot hand and gambler's fallacy biases. We demonstrate

the existence of significant biases even in this, sophisticated,

population, providing an important robustness check on previous

laboratory data. Like this previous research, we observe significant

individual heterogeneity in the population. Our participants are split

almost evenly between betting in a way consistent with the gambler's

fallacy and consistent with the hot outcome.

Importantly, however, our data allow us to investigate the

correlation of these biases at the individual level. We find

that gambler's fallacy players are more likely to also be hot

hand gamblers. These relationships suggest there may be an

underlying construct determining biased beliefs that further

research might illuminate. Candidates for this construct have

been suggested by us and others (locus of control,

representativeness, cognitive reflection of Frederick [2005]),

but further research in the lab will be need to identify these

potential mediators.

These results are consistent with those previously observed in

the lab (e.g., Ayton & Fischer, 2004; Chau & Phillips, 1995).

That these observations are robust in the field with real money

on the line and real participants is reassuring. However, the

limitations inherent in field data admit of alternative

interpretations of our results. For example, the hot outcome

effect may be explained by an availability bias; individuals are

more likely to bet on numbers that have recently won not because

they believe these numbers more likely to win again but instead

because they're easily called to mind. The hot hand effect may

be explained by an income or house money effect; individuals bet

on more numbers after they have won not because they believe that

they (personally) are more likely to win again but because

they're richer, or are playing with the house's money. While

these alternative explanations can explain some results, they

don't provide satisfactory explanations for the heterogeneity of

the data at the individual level, nor for the correlation between

the biases observed within the individual.

These limitations suggest further research combining empirical

and questionnaire data in a way that we were prevented from

accomplishing here. For example, a think-aloud protocol might

provide evidence in favor or against these alternative

explanations. Gathering psychological measures like locus of

control as well as demographic information might help us to

predict what type of biased beliefs an individual is likely to

have. Finally, our data infers beliefs from observed actions;

eliciting beliefs directly via a questionnaire, then observing

actions would provide a useful check on our results. These

combinations of field and lab data are attractive, but will

require extreme cooperation from a casino, which is not currently

available.

Other future projects might involve data from other non-autocorrelated

casino games (e.g., craps, slot machines) both to replicate our current

findings and to search for differences between the games. Finally,

there are a number of other questions one might explore using the

existing data including conformity (the correlation of betting across

players as in Blank, 1968), the status quo bias (probability of leaving

winning bets as they lie), the psychology of near misses (when an

individual's bet almost wins), and when players leave the game

(breaking even, busting out). While these data are not as targeted as

that from the lab, we see empirical data as an opportunity to provide a

robustness-check on (and external validity for) experimentally-observed

biases.

Almost every decision we make involves uncertainty in some way, both

over individual events and over sequences of events. Previous research

has demonstrated a number of biases in how individuals perceive and

react to this uncertainty, but the demonstrations have been primarily

in the lab, using undergraduate student participants. This paper uses

data from individuals gambling with their own money in a casino to test

for the presence of these biases in a naturally-occurring environment.

The behavior we observe is indeed consistent with previously-observed

biases, providing an important robustness check on the previous

research. We observe significant individual heterogeneity among the

population in their direction and strength of each bias.

In addition, our data allows us to identify these biases separately

within each individual, and to examine the correlation between them.

We find a significant and positive correlation between individuals who

act in accordance with gambler's fallacy beliefs and with hot hand

beliefs, suggesting a unifying cause for the two illusions. Further

research will be needed to identify this cause, and to help us predict

an individual's biases and their resulting actions.

References

Ayton, P. & Fischer. I. (2004). The gambler's fallacy and the

hot-hand fallacy: Two faces of subjective randomness? Memory

and Cognition, 32, 1369-1378.

Baron, J. & Ritov, I. (2004). Omission bias, individual differences,

and normality. Organizational Behavior and Human Decision

Processes, 94, 74-85.

Blais, A-R., & Weber, E. U. (2006). A domain-specific

risk-taking (DOSPERT) scale for adult populations.

Judgment and Decision Making, 1, XX-XX.

Blank, A. D. (1968). Effects of group and individual conditions

on choice behavior. Journal of Personality and Social

Psychology, 8, 294-298.

Chau, A. & Phillips, J. (1995). Effects of Perceived Control Upon

Wagering and Attributions in Computer Blackjack. The Journal

of General Psychology, 122, 253-269.

Croson, R. & Sundali, J. (2005). The gambler's fallacy and the hot

hand: Empirical data from casinos. Journal of Risk and

Uncertainty, 30, 195-209.

Edwards, W. (1961). Probability learning in 1000 trials.

Journal of Experimental Psychology, 62, 385-394.

Estes, W. K. (1964). Probability learning. In A. W. Melton (ed.),

Categories of Human Learning. New York: Academic Press.

Ethier, S. N. (1982). Testing for favorable numbers on a roulette

wheel. Journal of the American Statistical Association, 77,

660-665.

Feldman, J. (1959). On the negative recency hypothesis in the

prediction of a series of binary symbols. American Journal of

Psychology, 72, 597-599.

Friedland, N. (1998). Games of luck and games of chance: The effect

of luck- versus chance-orientation on gambling decisions.

Journal of Behavioral Decision Making, 11, 161-179.

Frederick, S. (2005). Cognitive reflection and decision making.

Journal of Economic Perspectives, 19, 25-42.

Gal, I. & Baron. J. (1996). Understanding repeated choices.

Thinking and Reasoning, 2, 81-98.

Gilovich, T., Vallone, R. & Tversky, A. (1985). The hot hand in

basketball: On the misperception of random sequences.

Cognitive Psychology, 17, 295-314.

Harris, C. R., Jenkins, M., & Glaser, D. (2006). Gender

differences in risk assessment: Why do women take fewer risks

than men? Judgment and Decision Making, 1, XX-XX.

Kahneman, D. & Tversky, A. (1972). Subjective probability: A

judgment of representativeness. Cognitive Psychology, 3,

430-454.

Keren, G. & Lewis, C. (1994). The two fallacies of gamblers: Type I

and Type II. Organizational Behavior and Human Decision

Processes, 60, 75-89.

Keren, G. & Wagenaar, W.. (1985). On the Psychology of Playing

Blackjack: Normative and Descriptive Considerations with Implications

for Decision Theory. Journal of Experimental Psychology:

General, 114, 133-158.

Langer, E. (1975). The illusion of control. Journal of

Personality and Social Psychology, 32, 311-328.

Lee, W. (1971). Decision theory and human behavior. New

York: Wiley.

Leopard, A. (1978). Risk preference in consecutive gambling.

Journal of Experimental Psychology: Human Perception and

Performance, 4, 521-528.

Lindman, H., & Edwards, W. (1961). Supplementary report: Unlearning

the gambler's fallacy. Journal of Experimental Psychology,

62, 630.

Oldman, D. (1974). Chance and skill: A study of roulette.

Sociology, 8, 407-426.

Rapoport, A. & Budesceu, D. (1992). Generation of random series in

two-person strictly competitive games. Journal of Experimental

Psychology: General, 121, 352-363.

Ritov, I. & Baron, J. (1992). Status-quo and omission bias.

Journal of Risk and Uncertainty, 5, 49-61.

Rotter, J. B. (1966). Generalized expectancies for internal vs. external

control of reinforcement. Psychological Monographs, 80, 1-28.

Samuelson, W. & Zeckhauser, R. (1988). Status quo bias in decision

making. Journal of Risk and Uncertainty, 1, 7-59.

Thaler, R. H., & Johnson, E. J. (1990). Gambling with the house

money and trying to break even: The effects of prior outcomes on

risky choice, Management Science 36, 643-660.

Tversky, A. & Kahneman, D. (1971). Belief in the law of small

numbers. Psychological Bulletin, 76, 105-110.

Tversky, A. & Kahneman, D. (1974). Judgement under uncertainty:

Heuristics and biases. Science, 185, 1124-1131.

Wagenaar, W. (1972). Generation of random sequences by human subjects:

A critical survey of literature. Psychological Bulletin, 77,

65-72.

Wagenaar, W. (1988). Paradoxes of gambling behavior. Lawrence

Erlbaum Associates, London, UK.

Weber, E. U., Anderson, C. J. & Birnbaum, M. H. (1992). A

theory of perceived risk and attractiveness.

Organizational Behavior and Human Decision Processes,

52, 492-523.

Zimbardo, P. G. (1985). Psychology and Life. Glenview,

IL: Scott Foreman and Company.

Footnotes:

1The authors thank Eric Gold for

substantial contributions in earlier stages of this research.

Thanks also to Jeremy Bagai, Dr. Klaus von Colorist, Bradley

Ruffle, Paul Slovic, Willem Wagenaar, participants of the

J/DM and ESA conferences, at the Conference on Gambling and

Risk Taking and at seminars at Wharton, Caltech and INSEAD

for their comments on this paper. Special thanks to the

Institute for the Study of Gambling and Commercial Gaming for

industry contacts which resulted in the acquisition of the

observational data reported here. Financial support from NSF

SES 98-76079-001 is also gratefully acknowledged. All

remaining errors are ours. Address correspondence to Rachel

Croson, 567 JMHH, The Wharton School University of

Pennsylvania, 3730 Walnut Street, Philadelphia, PA

19104-6340,

crosonr@wharton.upenn.edu.

James Sundali's email is

jsundali@unr.nevada.edu

2Or, more generally, a belief in a more

negative autocorrelation than is present. Thus when an

individual overestimates the amount of negative autocorrelation

in any sequence, we could say they were exhibiting gambler's

fallacy beliefs as well.

3Or, more generally, a belief in a more

positive autocorrelation than is present. Thus when an

individual overestimates the amount of positive autocorrelation

in any sequence, we could say they were exhibiting hot outcome

beliefs as well.

4The hot outcome bias is related but not identical

to the construct referred to by Keren and Lewis (1994) as the gambler's

fallacy type II. They present results of a questionnaire study in the

lab demonstrating that individuals underestimate the number of

observations necessary to detect biased roulette wheels. Thus after

seeing even a small streak of red numbers, gamblers might believe the

wheel is biased and expect more red numbers. The number of spins

participants believe they need to observe to detect a biased wheel,

while significantly smaller than the true number of spins necessary, as

derived in Ethier (1982), is significantly larger than the number of

spins any individual in our data set will observe.

5One can construct other explanations for the

behavior we here attribute to the hot outcome. For example,

perhaps numbers that have recently hit on the roulette wheel

are more available to the gambler than other numbers.

This availability may cause the gambler to bet on numbers that

have recently hit. Unfortunately in our empirical data we will

not be able to distinguish between these alternative causes of

this behavior, although previous lab research can and has done

so.

6As with the hot outcome above,

there are alternative explanations for these behaviors as well.

For example, wealth effects or house money effects might cause

an increase in betting after a win (hot hand) (Thaler &

Johnson 1990). Prospect theory's assumption of increased

risk-seeking in losses might cause an increase in betting after

a loss (stock of luck). In the lab, these effects can be

separated by eliciting beliefs directly as in Ayton and Fischer

(2004). In our empirical data we will not be able to

distinguish between these alternative explanations.

7Our companion paper, Croson and

Sundali (2005) has examined thee data at the aggregate level. There we

provide evidence that the wheel is unbiased, that gambler's fallacy

behavior is observed in outside bets after long streaks (5 and 6

observations of the same type), and that, in aggregate, individuals

place more bets after they have won a previous bet than after they have

lost one (or than on their first spin).

8This statement is not strictly

true. One bet has a house advantage of 7.89%. The bet

involves placing a chip on the outside corner of the layout

between 0 and 1. The bet wins if 0, 00, 1, 2 or 3 appears, but

pays only 6 for 1 (as though the bet were covering 6 numbers

instead of 5). We observed only 75 instances of this bet being

placed (out of 22,527 bets). Only 11 different individuals

placed this bet (out of 139 identifiable individuals in our

data), and of them, only 6 placed this bet more than twice.

9At the time of data collection a casino in

Washoe County, Nevada, was classified as "large" by the Nevada

Gaming Control Board if total (yearly) gaming revenues for the

property exceeds $36 million.

10The three time blocks were from 4:00 p.m. to 10:00

p.m., 8:00 p.m. to 2:00 a.m., and 10:00 p.m. to 4:00 a.m.

These time blocks were appropriate since the majority of gaming

business is done in the evening hours.

11This coding has the potential to introduce two

possible errors; two different people could be counted as the same

person, or the same person could be counted as two different people.

We believe that the first of these errors is minimized; when chips were

depleted and someone immediately purchased more, the coder could

recognize from their hand characteristics if it was the same person.

Additionally, this casino has many roulette tables, it was rare that

this table was full or that people were waiting to buy in immediately

after someone had gone bust. The second error may be somewhat more

likely, here we rely on the observation that if an individual wants to

rebuy, (s)he rarely waits to do so.

12 Based on the work of Ethier (1982),

Keren and Lewis (1994) report that the number of observations necessary

to detect a favorable number (bias) is generally quite large. For

example, on a wheel with 37 numbers it would be necessary to view

30,195 spins in order to detect a bias of 1/33 with a 90% level of

certainty.

13This behavior is consistent with the status quo

bias (Samuelson and Zeckhauser 1988) or the omission/commission

bias (Ritov and Baron 1992, Baron and Ritov 2004), as this chip

represents a bet that has been placed by default. Thus one can

interpret a positive significant coefficient on this variable

as evidence for these biases in this dataset. A positive

coefficient on this variable is also consistent with Wagenaar

(1988) who found 70 out of 75 winning bets in his data were not

moved. However, as this is not the main focus of our paper, we

do not provide a lengthy discussion of this finding.

Interested readers are encouraged to contact the author for

further discussion.

14Other possible categorizations yield

qualitatively identical results (e.g., using those categorized both

significantly and nonsignificantly regardless of error, restricting

attention to those categorized significantly, either only without error

or all and using the logistic models to categorize the Gambler's

Fallacy/Hot Outcome subjects rather than the linear models).

File translated from

TEX

by

TTH,

version 3.74.

On 17 Jul 2006, 04:07.