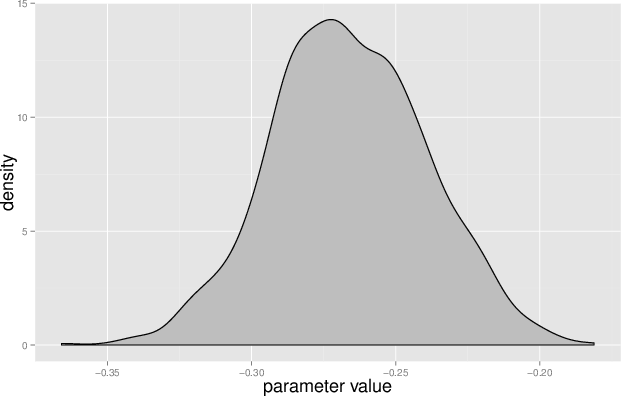

| Figure 1: Density of the coefficient α2. |

Judgment and Decision Making, Vol. 12, No. 2, , pp. 168-172

Home bias in sport betting: Evidence from Czech betting marketRostislav Staněk* |

In sport betting, bettors exhibit home bias when they tend to bet on their home team more often. The paper offers a straightforward method of empirical identification of the home bias in the real-world betting market. Using Czech betting data on the league and the national ice-hockey matches, the paper provides support for the existence of the home bias in the Czech betting market.

Keywords: home bias, betting market, sentimental betting,

Many of our everyday decisions, such as buying insurance, accepting a job offer or placing a bet, are made under uncertainty. It is a well-known fact that people are prone to making biased judgments in these situations. The focus of this study is to investigate the so-called home bias. The home bias has been observed in a typical financial market where investors tend to concentrate their equity investment in their domestic market (Graham, Harvey & Huang, 2009; Strong & Xu, 2003). A similar bias could appear in sports betting. In the context of sports betting, the home bias is a phenomenon best described by bettor’s tendency to bet predominantly on their home team.

There are two reasons why the betting market seems to provide a good environment for studying real-world probability judgments in general, and the home bias in particular. First, people are incentivized by wagering their own money. Secondly, the true value of assets (bets) is revealed with certainty in a short period of time, i.e., when the result of the sport event becomes known.

It has been well-documented in many experimental tasks that subjects in experiments tend to overweight the winning probability of a particular team. Several studies have found a strong relationship between the team that was favored by the fans and the team they predicted would win the match (Babad, 1987; Babad & Katz, 1991; Massey, Simmons & Armor, 2011; Simmons & Massey, 2012; Russo & Corbin, 2016; Morewedge, Tang & Larrick, 2016). The relationship between desirability and optimism might occur even if the team allegiance is assigned by experimental design (Price, 2000; Krizan & Windschitl, 2007). Other studies show that participants tend to overestimate the winning probability of the more familiar team (Pachur & Biele, 2007; Ayton, Önkal & McReynolds, 2011) or the team which is made more salient by experimental manipulation (Bar-Hillel & Budescu, 1995; Bar-Hillel, Budescu & Amar, 2008). Whether it is familiarity or popularity that makes the home team special, these studies provide support for the existence of the home team bias in the real-world betting market.

However, studies that look for the home bias in the real-world betting market produce inconclusive results. One group of studies relies on various measures of teams’ popularity in order to detect the difference between the betting odds on more and less popular teams. Forrest and Simmons (2008) measure the popularity of Spanish football teams by home attendance and Feddersen, Humphreys and Soebbing, (2016) use all-star votes. Both studies arrive at the conclusion that the betting odds on the more popular teams are less favorable, suggesting that bettors bet more on the more popular teams. The methodological problem regarding this approach is that the successful teams attract more fans, so the higher betting could result from their success rather than from other factors that would affect their popularity (such as being the home team).

Another group of studies avoid this problem by using betting odds on international matches set by bookmaker companies from different countries. As the vast majority of bettors support their own national teams, this approach does not have to rely on any additional and potentially confounded popularity proxies. Page (2009) uses data from international football matches and European cup matches to study whether the rate of return is lower when betting on the win of the team which comes from the same country as the bookmaker. He finds no such difference, and consequently, no evidence of the home bias. Braun and Kvasnicka (2013) compare the betting odds on national team football matches set by bookmakers from different European countries. Their approach was to test whether there is any difference between the odds set by the domestic and the foreign bookmakers. They found a consistent home bias in three European countries and an opposite pattern in two of the twelve European countries in their sample. The crucial assumption underlying this approach is that a difference in market structure and legal regulations among national markets affects only the average level of all odds and not the individual odds of different countries.

This paper presents a new and straightforward method of how to identify the home team bias in the real-world betting market. The method proposed in this paper follows the assumption that the home bias should be observed in bets on the win of the national team. This measure is clearly exogenous and does not raise endogeneity concerns. But instead of comparing odds set by bookmakers from different countries, the method identifies the home bias by estimating a logit model where the dependent variable is the success of the bet and the explanatory variables are the constant and the logarithm of the possible net return and home team dummy variable. The proposed method requires data from only one betting market.

In order to show that this method has a potential to identify the home team bias, I apply this method to the Czech betting data on ice-hockey matches of the Czech national team and league matches. There are two reasons why ice-hockey bets are especially suitable for this purpose. Firstly, ice-hockey is the most popular sport in the Czech Republic and the Czech national team is popular and well known among the Czech citizens. Secondly, there are around 30 matches of the Czech team per season which is more than in other popular sports.

This section explains the main idea behind the identification strategy employed in this paper. Suppose that bettors are subject to the home team bias, so they want to bet predominantly on the home team win. The bettors are therefore willing to accept less favorable odds when betting on the home team. There are two potential bookmaker’s reactions to the bettors’ bias. If the bookmaker does not want to take a risky position, he will set the odds to balance the monetary value of the bets placed on each side of the bet. Then, the odds against the home team have to be higher (and, therefore, the odds favoring the home team lower) in order to attract bettors. If the bookmaker is willing to take the unbalanced position, he will maximize his profit by exploiting the bias, setting lower odds for the win of the home team (Levitt, 2004). In both cases, the probability that the bet on the home team win is successful is lower than the probability of the regular bet with the same odds. Regular bet refers to a bet on a match in which the home team does not participate.

The implication that there should be a difference in the success probability of the bet on the home team and a regular team offers a way to identify the home bias. The identification strategy employed in this paper aims at finding out whether the probability of the home team win is lower than the probability of a regular team win given the same odds.

Obviously, the winning probabilities are not directly observable – only the actual outcome of the bet. The standard solution to this problem is to estimate the logit model where the dependent variable is a binary variable denoting the result of the bet. This is equivalent to the formulation where the dependent variable is the logarithm of the winning odds.1 In order to control for the betting odds appropriately, they are transformed in the same way and the following model is estimated:

| Ri=α0+α1 log(Oi−1)+α2 Home, (1) |

where the dependent variable Ri is a binary variable which takes the value 1 if the bet was successful and 0 otherwise, Oi are the odds set by the bookmaker and Home is a dummy variable which takes the value 1 if the bet was on the win of the home team and 0 otherwise.

The parameter α0 measures the unfairness of the betting odds in comparison with the winning odds, and the parameter α1 measures the difference in profitability between bets on favorites and longshots. Suppose that the bookmaker offers fair odds for each match, the corresponding parameter values are α0=0 and α1=−1. Since it is generally acknowledged that bookmakers make some profit, the expected sign of α0 is negative. The expected value of the coefficient is α1 < −1 due to the well-established fact that bets on favorites are more profitable than bets on longshots (Snowberg & Wolfers, 2010; Ottaviani & Sørensen, 2008). The parameter α2 measures the home bias. The negative value of the coefficient α2 indicates the presence of the home bias as the winning probability of the home team bets is lower than the winning probability of a regular team bets, given the same betting odds.

The dataset used in the following empirical analysis comes from the Czech commercial database Trefik. It contains the closing odds and results of 9,404 ice-hockey matches between 1997 and 2014. There are 7,073 matches from the Czech league and 2,331 international matches. The Czech national team participated in 513 international matches. The odds were set by the largest Czech bookmaker – the company Tipsport. The dataset contains the following variables for each match:

This section provides a detail description of the estimation procedure.

The estimation procedure has to deal with the problem that different outcomes of the same match are not independent. If the odds on the particular team are biased upwards, then the odds on the opponent are biased downwards. Similarly, one team winning the match means that the opponent has lost the match. In order to preserve the independence of observations, a sample of independent outcomes is created in the following way. If the Czech national team takes part in the match, the bet on the win of the Czech national is chosen. In case of regular matches, one of the outcomes on which the bet is placed is chosen randomly. The sample thus includes all 513 bets on the win of the Czech national team and 8891 randomly selected bets from other matches. The Odds, the date, the result of the bet and the identification variables defined above are recorded for each bet.

This sample represents the input for the estimation of the model described by (1). Since the estimation results depend on the random selection of outcomes of regular matches, I performed this estimation on 1,000 randomly chosen samples. Each sample includes the same bets on the Czech national team win and a random selection of bets from regular matches. The aim of the repetition is to verify that the results are not sensitive to the random selection of bets.

To further verify the robustness of the results, I have estimated two additional model specifications. The first additional specification contains year fixed effects as a control for the possible time-specific unobservable characteristics of the betting market. The specification of the model is defined by the following equation, where the index t refers to the year:

| Ri=α0,t+α1 log(Oi−1)+α2 Home. (2) |

A concern may also arise that the preferences of bettors differ between the bets on the international matches and the Czech league matches. Henceforth, I estimated the models (1) and (2) using only the subsample of bets from the international matches.

Table 1 reports the estimation results. Specifically, it shows the results of the estimation with the median value of the parameter α2.

Table 1: Results of logit regressions.

Figure 1: Density of the coefficient α2.

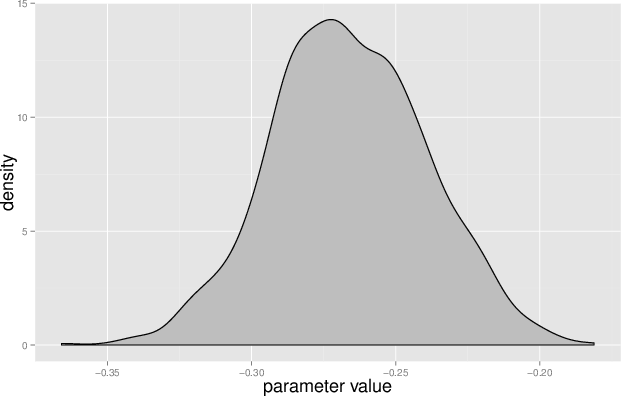

Figure 2: Density of the p-values of the coefficient α2.

Column 1 reports the estimation of the equation (1) on the sample of international and league matches. It provides evidence for the existence of the optimism bias as the coefficient for the bets on the win of the Czech national team is significantly less than zero.

The results from all 1,000 estimations are very similar. Figures 1 and 2 illustrate that the results are not driven by the random sample selection. Figure 2 depicts the Kernel density of the coefficient α2 from all the estimations. The coefficient α2 is negative in all the random samples estimations with median value −0.267. Figure 3 shows the Kernel density for the p-values of the coefficient α2. The negative values of the coefficient are statistically significant at the 5% level in more than 99% of samples. The maximum p-value from all the random samples estimations is 0.08.

Additional columns in Table 1 present the robustness checks. Column 2 presents the estimation results of the model with year fixed effects. The parameter α2 is still negative and highly statistically significant. Columns 3 and 4 present the estimation results using only the sample of the international matches. Column 4 includes year fixed effects. These results suggest that the evidence supporting the home team bias is robust.

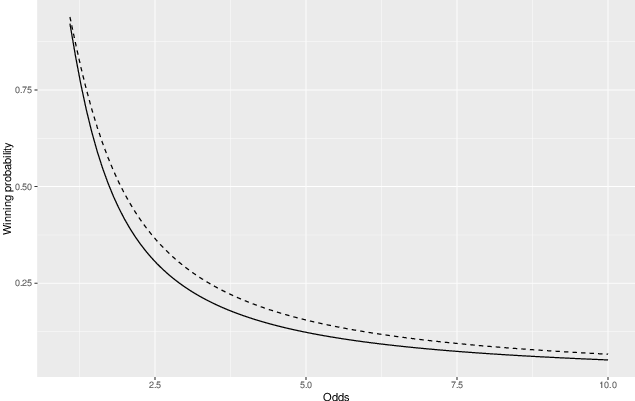

Figure 3 presents the estimated relationship between the betting odds and the winning probabilities based on the column 1 of the Table 1. The solid line describes the relationship for bets on the win of the Czech national and the dashed line corresponds to normal bets. The figure shows the home team bias is not only statistically significant, but also quantitatively substantial. The difference in the winning probability between the home team bets and the regular bets is about 0.07 for the tight matches. For example, regular bet at the odds 2 is almost fair, the winning probability is 0.48, whereas the home team bet at the same odds gives the winning probability 0.41.

Figure 3: Betting odds and winning probability.

Previous research found some evidence for the existence of the home team bias. This paper offers a straightforward method of the home bias identification and it shows that the home bias exists on the Czech betting market. There are several explanations of the source of the home bias which can be divided according to what makes the home team special.

One group of explanations is based on the assumption that the bettors are also supporters of the home team. The home bias can be caused by the optimism bias (Babad & Katz, 1991; Krizan & Windschitl, 2007). The optimism bias is the idea that people’s desire exhibits causal influence on their expectations – specifically, people overestimate the likelihood of positive events and underestimate the likelihood of negative events. As the win of the national team is desired, the bettor’s perception of the national team’s chances of winning may be biased upwards. Interestingly, the experimental evidence shows that optimism bias persists in the environment with unearned, but significant monetary incentives (Simmons & Massey, 2012) and unambiguous feedback (Massey et al., 2011).

Another group of explanations proposes that bettors have a better knowledge of the home team. The home bias in stock markets is sometimes explained by the competence effect (Graham et al., 2009). The Competence effect states that people’s willingness to act on their own judgment depends on their subjective competence (Heath & Tversky, 1991). Therefore, if the bettors feel knowledgeable about their home team, they might be more willing to bet on the home team matches. However, the competence effect does not explain why they should predominantly bet on the home team and not against it. Still, the home team bias may be explained by the fact that bettors tend to bet on the team they know (Pachur & Biele, 2007; Ayton et al., 2011). Similarly, Bar-Hillel et al. (2008) show that bettors overestimate the winning probability of the salient option. As the home team is better known and salient, this may also explain the home bias.

Whatever is the cause of the home bias, the results suggest that the home bias persists in the environment with significant monetary incentives and unambiguous feedback.

Ayton, P., Önkal, D., & McReynolds, L. (2011). Effects of ignorance and information on judgments and decisions. Judgment and Decision Making, 6(5), 381–391.

Babad, E. (1987). Wishful thinking and objectivity among sports fans. Social Behaviour, 2 (4), 231–240.

Babad, E., & Katz, Y. (1991). Wishful thinking—against all odds. Journal of Applied Social Psychology, 21(23), 1921–1938.

Bar-Hillel, M., & Budescu, D. (1995). The elusive wishful thinking effect. Thinking & Reasoning, 1(1), 71–103.

Bar-Hillel, M., Budescu, D. V., & Amar, M. (2008). Predicting world cup results: Do goals seem more likely when they pay off? Psychonomic Bulletin & Review, 15(2), 278–283.

Braun, S., & Kvasnicka, M. (2013). National sentiment and economic behavior evidence from online betting on European football. Journal of Sports Economics, 14(1), 45–64.

Feddersen, A., Humphreys, B. R., & Soebbing, B. P. (2016). Sentiment bias in national basketball association betting. Journal of Sports Economics, Advance online publication, http://journals.sagepub.com/doi/full/10.1177/1527002516656726.

Forrest, D., & Simmons, R. (2008). Sentiment in the betting market on Spanish football. Applied Economics, 40(1), 119–126.

Graham, J. R., Harvey, C. R., & Huang, H. (2009). Investor competence, trading frequency, and home bias. Management Science, 55(7), 1094–1106.

Heath, C., & Tversky, A. (1991). Preference and belief: Ambiguity and competence in choice under uncertainty. Journal of risk and uncertainty, 4(1), 5–28.

Krizan, Z., & Windschitl, P. D. (2007). Team allegiance can lead to both optimistic and pessimistic predictions. Journal of Experimental Social Psychology, 43(2), 327–333.

Levitt, S. D. (2004). Why are gambling markets organised so differently from financial markets? The Economic Journal, 114(495), 223–246.

Massey, C., Simmons, J. P., & Armor, D. A. (2011). Hope over experience desirability and the persistence of optimism. Psychological Science, 22(2), 274–281.

Morewedge, C. K., Tang, S., & Larrick, R. P. (2016). Betting your favorite to win: Costly reluctance to hedge desired outcomes. Management Science, Advance online publication, http://pubsonline.informs.org/doi/pdf/10.1287/mnsc.2016.2656.

Ottaviani, M., & Sørensen, P. N. (2008). The favorite-longshot bias: An overview of the main explanations. In Hausch, D. B., & Ziemba, W. T. (Eds.) Handbook of Sports and Lottery Markets, pp. 83–101.

Pachur, T., & Biele, G. (2007). Forecasting from ignorance: The use and usefulness of recognition in lay predictions of sports events. Acta Psychologica, 125(1), 99–116.

Page, L. (2009). Is there an optimistic bias on betting markets? Economics Letters, 102(2), 70–72.

Price, P. C. (2000). Wishful thinking in the prediction of competitive outcomes. Thinking & Reasoning, 6(2), 161–172.

Russo, J. E., & Corbin, J. C. (2016). Not by desire alone: The role of cognitive consistency in the desirability bias. Judgment and Decision Making, 11(5), 449–459.

Simmons, J. P., & Massey, C. (2012). Is optimism real? Journal of Experimental Psychology: General, 141(4), 630–634.

Snowberg, E., & Wolfers, J. (2010). Explaining the favorite–long shot bias: Is it risk-love or misperceptions? Journal of Political Economy, 118(4), 723–746.

Strong, N., & Xu, X. (2003). Understanding the equity home bias: Evidence from survey data. Review of Economics and Statistics, 85(2), 307–312.

Copyright: © 2016. The authors license this article under the terms of the Creative Commons Attribution 3.0 License.

This document was translated from LATEX by HEVEA.