Below you can get pdf copies of my papers and codes for reproducing some of the computations involved.

New Items

July 19, 2024. A new version of “Filtering with Limited Information,” with Thorsten Drautzburg, Pablo Guerrón-Quintana, and Dick Oosthuizen can be found here.

May 6, 2024. A new paper “Classical Right, New Right, and Voting Behavior: Evidence from a Quasi-Natural Experiment,” with Carlos Sanz here.

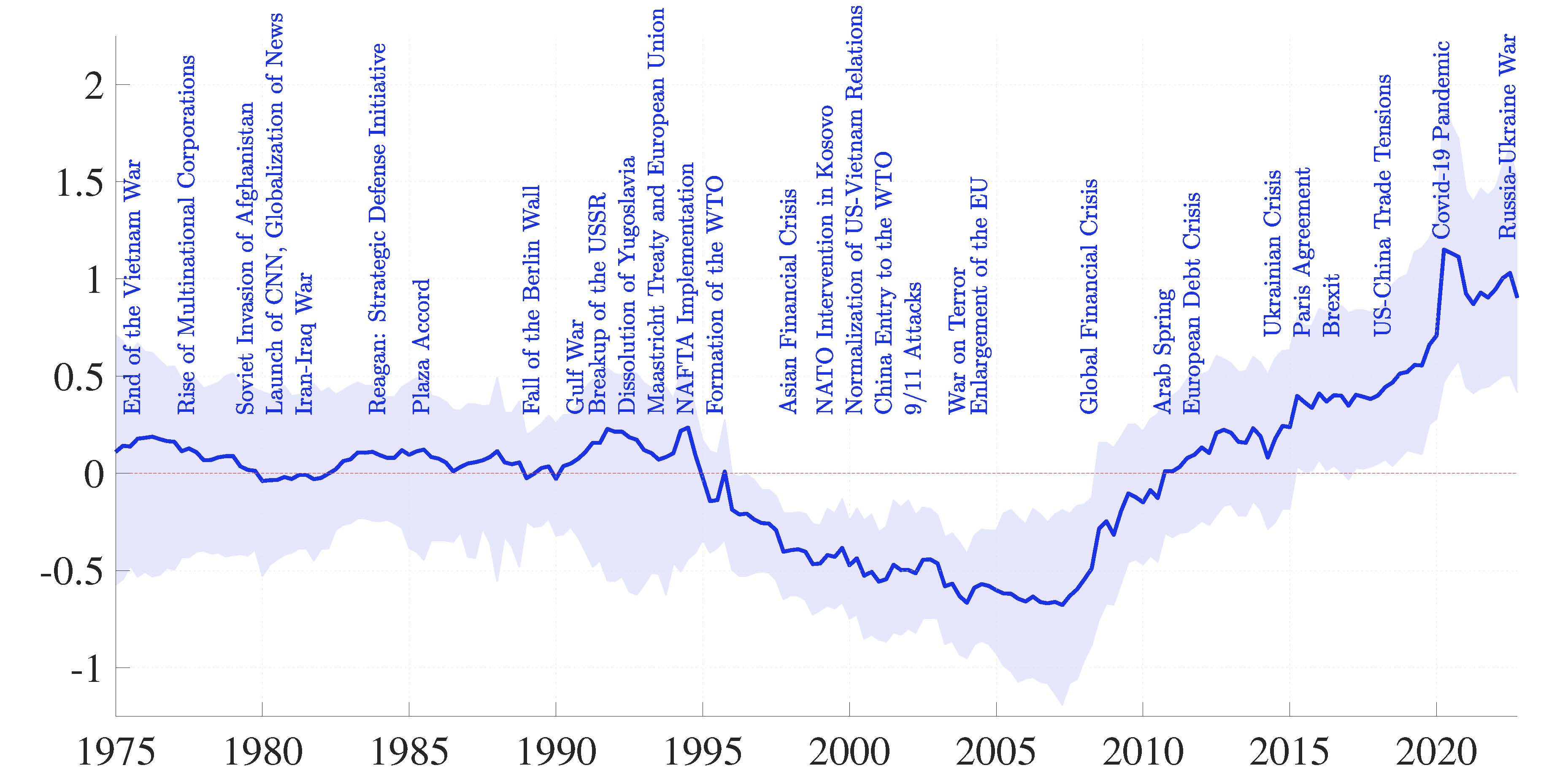

March 19, 2024. A first version of the paper “Are We Fragmented Yet? Measuring Geopolitical Fragmentation and its Causal Effects,” with Tomohide Mineyama and Dongho Song here.

The figure above plots our estimated index of geopolitical fragmentation. You can get the data here. You are free to use the index, but please do cite us.

March 8, 2024. A new version of the paper “Technological Synergies, Heterogenous Firms, and Idiosyncratic Volatility,” with Yang Yu and Francesco Zanetti here.

February 29, 2024. The paper “Navigating by Falling Stars: Monetary Policy with Fiscally Driven Natural Rates,” with Rodolfo Campos, Galo Nuño, and Peter Paz can be found here. Finally, a 30-minute talk based on the paper can be found below:

February 21, 2024. The paper “The Distributional Effects of Asset Returns,” with Oren Levintal can be found here.

January 31, 2024. The paper “The Causal Effects of Global Supply Chain Disruptions on Macroeconomic Outcomes: Evidence and Theory,” with Xiwen Bai, Yiliang Li, and Francesco Zanetti can be found here (large file, it will take a few seconds to load). Slides here. The Wall Street Journal has covered our empirical results here and Omnia here.

January 31, 2024. A new version of my paper “Dynamic Programming in Economics on a Quantum Annealer,” with Isaiah Hull can be found here. We changed the title of the paper to emphasize that we develop novel algorithms specifically designed for quantum annealers (QAs) (standard classical algorithms such as VFI do not even run on QAs). To demonstrate how these algorithms work, we do solve an RBC model in an actual QA. This is perhaps the hardest model that can be solved with the current generation of QAs, but our algorithm is fully scalable to higher dimensions when the new generations of QAs come online. We run our code on Advantage, the QA produced by D-Wave Systems, with 5000 qubits. Also, a link to the github repo. Finally, a 50-minute talk based on the paper can be found below:

January 17, 2024. The final version paper “Central Bank Digital Currency: When Price and Bank Stability Collide” (now forthcoming at the Journal of Monetary Economics) with Linda Schilling and Harald Uhlig can be found here. Now we include a new and very nice decentralization with firms and private banks in Section 6. The slides are here. A short summary for a CEPR e-book can be found here.

November 19, 2023. A new paper “The Wealth of Working Nations,” with Gustavo Ventura and Wen Yao can be found here and slides here. Some coverage at the Wall Street Journal, here. The Wall Street Journal has covered our empirical results here.

July 1, 2023. A (new) presentation on large language models in economics,” here. Also, the video (which covers most of the material in the presentation) can be found here:

July 1, 2023. A (new) presentation that summarizes much of my recent research “Taming the Curse of Dimensionality: Old Ideas and New Strategies,” here.

June 8, 2023. A new version of the paper “A Model of the Gold Standard,” with Daniel Sanches can be found here.

June 4, 2023. A new paper “The Neoclassical Growth of China,” with Lee Ohanian and Wen Yao here.

May 27, 2023. Slides for my new paper “Between the East and the West: The Life and Work of Alfred Zauberman,” with Andrej Svorenčík here. A draft will come soon!

May 25, 2023. A new paper “Accounting for the Duality of the Italian Economy,” with Dario Laudati, Lee Ohanian, and Vincenzo Quadrini here.

May 18, 2023. A new version of my paper “Inequality and the Zero Lower Bound,” with Joël Marbet, Galo Nuño, and Omar Rachedi here.

November 12, 2022. A first version new paper “Ricardian Business Cycles,” with Lorenzo Bretscher and Simon Scheidegger here.

October 21, 2022. A new paper “Spooky Boundaries at a Distance: Exploring Transversality and Stability with Deep Learning,” with Mahdi Ebrahimi Kahou, Sebastián Gómez-Cardona, Jesse Perla, and Jan Rosa here.

October 6, 2022. A new paper “Differentiable State-Space Models and Hamiltonian Monte Carlo Estimation,” with David Childers, Jesse Perla, Christopher Rackauckas, and Peifan Wu can be found here. The Github repo with the relevant packages is here.

August 25, 2022. My MFS guest lecture “Machine Learning for Macrofinance” can be found here. Also, the video can be found here:

August 25, 2020. A much updated version of my paper “The Fractured-Land Hypothesis” with Mark Koyama, Youhong Lin, and Tuan-Hwee Sng can be found here. Also, a VoxEU column here and a 15-minute video summarizing (a slightly older version of) the paper can be found here and below:

June 16, 2022. My paper “Politics and Income Distribution” with Thorsten Drautzburg and Pablo Guerrón-Quintana can be found here.

June 16, 2022. An updated version of my paper “Financial Frictions and the Wealth Distribution” with Galo Nuño and Samuel Hurtado can be found here. The slides are here.

April 21, 2022. An updated version of my paper “Search Complementarities, Aggregate Fluctuations, and Fiscal Policy” with Federico Mandelman, Yang Yu, and Francesco Zanetti can be found here.

April 4, 2022. A new paper “Programming FPGAs for Economics: An Introduction to Electrical Engineering Economics,” with Bhagath Cheela, André DeHon, and Alessandro Peri can be found here and the companion tutorial here.

March 7, 2022. A new paper “The Causal Effects of Lockdown Policies on Health and Macroeconomic Outcomes,” with Jonas E. Arias, Juan F. Rubio-Ramírez, and Minchul Shin can be found here. It supersedes “Bayesian Estimation of Epidemiological Models: Methods, Causality, and Policy Trade-Offs,” which can be found here for the record.

November 7, 2021. An updated version of my paper “Demographic Transitions Across Time and Space” with Matthew J. Delventhal and Nezih Guner can be found here. We also have a companion web page with all the data set here.

November 6, 2021. The slides “Deep Learning for Macroeconomists,” a plenary talk I have prepared for several events, can be found here. See, also, under teaching, the slides for my course on machine learning for macroeconomics.

July 30, 2021. The paper “Has Machine Learning Rendered Simple Rules Obsolete?,” can be found here. A summary for the general public is here. The slides (with the old title) are here.

June 22, 2021. The new paper “Exploiting Symmetry in High-Dimensional Dynamic Programming,” with Mahdi Ebrahimi Kahou, Jesse Perla, and Arnav Sood can be found here. The slides are here and the Github repo is here. Also, a 63 minutes video summarizing the paper can be found here:

Solution and Estimation Methods for DSGE Models

Joint with Juan Rubio-Ramírez and Frank Schorfheide.

The New Macroeconometrics: A Bayesian Approach

Joint with Pablo Guerrón-Quintana and Juan F. Rubio-Ramírez.

Joint with Lorenzo Bretscher and Simon Scheidegger.

Spooky Boundaries at a Distance: Exploring Transversality and Stability with Deep Learning

Joint with Mahdi Ebrahimi Kahou, Sebastián Gómez-Cardona, Jesse Perla and Jan Rosa.

Exploiting Symmetry in High-Dimensional Dynamic Programming

Joint with Mahdi Ebrahimi Kahou, Jesse Perla, and Arnav Sood.

Inequality and the Zero Lower Bound

with Joël Marbet, Galo Nuño, and Omar Rachedi.

Financial Frictions and the Wealth Distribution

Joint with Galo Nuño and Samuel Hurtado.

Has Machine Learning Rendered Simple Rules Obsolete? An older (longer) version is here.

Joint with Gustavo Ventura and Wen Yao.

The Neoclassical Growth of China

Joint with Lee Ohanian and Wen Yao.

Technological Synergies, Heterogenous Firms, and Idiosyncratic Volatility

Joint with Yang Yu and Francesco Zanetti.

Deciphering the Macroeconomic Effects of Internal Devaluations in a Monetary Union

Joint with Javier Andrés, Óscar Arce, and Samuel Hurtado.

Uncertainty Shocks and Business Cycle Research

Joint with Pablo Guerrón-Quintana.

Demographic Transitions Across Time and Space

Joint with Matthew J. Delventhal and Nezih Guner.

The "Matthew Effect" and Market Concentration: Search Complementarities and Monopsony Power

Joint with Federico Mandelman, Yang Yu, and Francesco Zanetti.

Search Complementarities, Aggregate Fluctuations, and Fiscal Policy

Joint with Federico Mandelman, Yang Yu, and Francesco Zanetti.

Bargaining Shocks and Aggregate Fluctuations

Joint with Thorsten Drautzburg and Pablo Guerrón-Quintana.

This paper previously circulated as “Political Distribution Risk and Aggregate Fluctuations.”

Optimal Capital Versus Labor Taxation with Innovation-Led Growth

Joint with Philippe Aghion and Ufuk Akcigit.

Nonlinear Adventures at the Zero Lower Bound

Joint with Grey Gordon, Pablo Guerrón-Quintana, and Juan Rubio-Ramírez.

Supply-Side Policies and the Zero Lower Bound

Joint with Pablo Guerrón-Quintana and Juan Rubio-Ramírez.

Fiscal Volatility Shocks and Economic Activity

Joint with Keith Kuester, Pablo Guerrón-Quintana and Juan Rubio-Ramírez.

Macroeconomics and Volatility: Data, Models, and Estimation

Joint with Juan Rubio-Ramírez.

Fortune or Virtue: Time-Variant Volatilities Versus Parameter Drifting in U.S. Data

Joint with Pablo Guerrón-Quintana and Juan Rubio-Ramírez.

Fiscal Policy in a Model with Financial Frictions.

An extended version of the model can be found here.

Risk Matters: The Real Effects of Volatility Shocks

Joint with Pablo Guerrón-Quintana, Juan F. Rubio-Ramírez, and Martin Uribe.

Joint with Jeremy Greenwood and Nezih Guner.

A,B,C's (and D)'s for Understanding VARs

Joint with Juan F. Rubio-Ramírez, Tom Sargent, and Mark Watson.

The older (and longer) working paper version is here.

Life-Cycle Consumption, Debt Constraints and Durable Goods

Joint with Dirk Krueger.

Consumption over the Life Cycle: Facts from Consumer Expenditure Survey Data

Joint with Dirk Krueger.

here you can find the technical appendix of the paper with further details about our estimation.

Optimal Fiscal Policy in a Business Cycle Model without Commitment (incomplete draft)

Joint with Aleh Tsyvinski.

Was Malthus Right? Economic Growth and Population Dynamics

Some Further Notes on "Was Malthus Right? Economic Growth and Population Dynamics"

These notes present further discussion of several aspects of "Was Malthus Right? Economic Growth and Population Dynamics." They should be read following each particular section of the main paper.

Can We Really Observe Hyperbolic Discounting?

Joint with the late Arijit Mukherji.

Evaluating Labor Market Reforms: A General Equilibrium Approach

Joint with Cesar Alonso-Borrego and Jose E. Galdon.

On the Solution of the Growth Model with Investment-Specific Technological Change

Joint with Juan F. Rubio-Ramírez.

Navigating by Falling Stars: Monetary Policy with Fiscally Driven Natural Rates

Joint with Rodolfo Campos, Galo Nuño, and Peter Paz.

Joint with Daniel Sanches.

Central Bank Digital Currency: when Price and Bank Stability Collide

Joint with Linda Schilling and Harald Uhlig.

Central Bank Digital Currency: Central Banking For All?

Joint with Daniel Sanches, Linda Schilling, and Harald Uhlig.

Can Currency Competition Work?

Joint with Daniel Sanches.

A short companion paper summarizing some of the findings can be found here

Cryptocurrencies and All That: Two Ideas from Monetary Economics

Also, the slides “Cryptocurrencies, Fintech, and All That: Monetary Economics in the 21st Century,” a plenary talk based on several of papers above on cryptocurrencies, can be found here.

Cryptocurrencies: A Crash Course in Digital Monetary Economics

Reading the Recent Monetary History of the U.S., 1959-2007

Joint with Pablo Guerrón-Quintana and Juan Rubio-Ramírez.

A Review Sesssion for Monetary and Fiscal Policy

The Distributional Effects of Asset Returns

Joint with Oren Levintal.

Joint with Robert Barro, Oren Levintal, and Andrew Mollerus.

The Term Structure of Interest Rates in a DSGE Model with Recursive Preference

Joint with Jules van Binsbergen, Ralph Koijen, and Juan Rubio-Ramírez.

Dynamic Programming in Economics on a Quantum Annealer

Joint with Isaiah Hull.

Programming FPGAs for Economics: An Introduction to Electrical Engineering Economics

The companion tutorial here.

Joint with Bhagath Cheela, André DeHon, and Alessandro Peri.

A Practical Guide to Parallelization in Economics

Joint with David Zarruk Valencia.

Github repository: here

Comparing Solution Methods for Dynamic Equilibrium Economies

Joint with S. Boragan Aruoba and Juan F. Rubio-Ramírez.

Click on this link to go to the companion web page where you can find the codes used in this paper.

Solution Methods for Models with Rare Disasters

Joint with Oren Levintal.

Companion code here.

A Comparison of Programming Languages in Economics

Joint with S. Boragan Aruoba.

The original paper has a short update (2018) with some new running times here.

Click on this link to go to the github repository for the codes used in this paper. Note that in the repository we have codes for many other programming languages such as JavaScript.

Joint with Eric Aldrich, Ron Gallant, and Juan Rubio-Ramírez

Computing DSGE Models with Recursive Preferences and Stochastic Volatility

Joint with Dario Caldara, Juan F. Rubio-Ramírez, and Yao Wen.

Solving DSGE Models with Perturbation Methods and a Change of Variables

Joint with Juan F. Rubio-Ramírez.

Mathematica Notebook to compute the optimal change of variables.

A Generalization of the Endogenous Grid Method

Joint with Francisco Barillas.

Fortran Code to compute the models describe in the paper using the Endogenous Grid Method and Value function iteration.

Our Research Agenda: Estimating DSGE Models

Joint with Juan F. Rubio-Ramírez.

This note, which appears in the newsletter of the Review of Economic Dynamics, fall 2006, describes our agenda on the estimation of DSGE Models. We discuss our different papers and explain how they fit together.

Filtering with Limited Information

Joint with Thorsten Drautzburg, Pablo Guerrón-Quintana, and Dick Oosthuizen.

Differentiable State-Space Models and Hamiltonian Monte Carlo Estimation

Joint with David Childers, Jesse Perla, Christopher Rackauckas, and Peifan Wu. The Github repo with the relevant packages is here.

Estimating DSGE Models: Recent Advances and Future Challenges

Joint with Pablo Guerrón.

A technical appendix is here.

The Pruned State-Space System for Non-Linear DSGE Models: Theory and Empirical Applications

Joint with Martin Andreasen and Juan F. Rubio-Ramírez.

A detailed technical appendix is here. Codes for Dynare 4.4: here.

The Econometrics of DSGE Models

MEDEA: A DSGE Model for the Spanish Economy

Joint with Pablo Burriel and Juan F. Rubio-Ramírez.

Estimating Macroeconomic Models: A Likelihood Approach

Joint with Juan F. Rubio-Ramírez.

The technical appendix offers further details in some aspects of the paper.

Sequential Monte Carlo Filtering: an Example

Here you can find an example of how to use a Sequential Monte Carlo to evaluate the likelihood function of a nonlinear and non-normal process.

Estimating Dynamic Equilibrium Economies: Linear versus Nonlinear Likelihood

Joint with Juan F. Rubio-Ramírez.

Comparing Dynamic Equilibrium Models to Data: a Bayesian approach

Joint with Juan F. Rubio-Ramírez.

How Structural Are Structural Parameter Values?

Joint with Juan F. Rubio-Ramírez.

Convergence Properties of the Likelihood of Computed Dynamic Models

Also, NBER Working Paper version, with more details.

Joint with Juan F. Rubio-Ramírez and Manuel Santos.

Are We Fragmented Yet? Measuring Geopolitical Fragmentation and its Causal Effects

Joint with Tomohide Mineyama and Dongho Song.

The Causal Effects of Global Supply Chain Disruptions on Macroeconomic Outcomes: Evidence and Theory

Joint with Xiwen Bai, Yiliang Li, and Francesco Zanetti.

Joint with Mark Koyama, Youhong Lin, and Tuan-Hwee Sng.

The Causal Effects of Lockdown Policies on Health and Macroeconomic Outcomes

Joint with Jonas Arias, Juan Rubio-Ramírez and Minchul Shin.

It supersedes Bayesian Estimation of Epidemiological Models: Methods, Causality, and Policy Trade-Offs

Estimating and Simulating a SIRD Model of COVID-19 for Many Countries, States, and Cities

Joint with Chad Jones.

Macroeconomic Outcomes and COVID-19: A Progress Report

Joint with Chad Jones.

Classical Right, New Right, and Voting Behavior: Evidence from a Quasi-Natural Experiment.

Joint with Carlos Sanz.

Accounting for the Duality of the Italian Economy.

Joint with Dario Laudati, Lee Ohanian, and Vincenzo Quadrini.

Politics and Income Distribution.

Joint with Thorsten Drautzburg and Pablo Guerrón-Quintana.

The Lack of European Productivity Growth: Causes and Lessons for the U.S.

Joint with Lee Ohanian.

Institutions and Political Party Systems: The Euro Case

Joint with Tano Santos.

Political Credit Cycles: the Case of the Euro Zone

Joint with Luis Garicano and Tano Santos.

The Spanish Crisis from a Global Perspective

Joint with Lee Ohanian.

The Economics of Minimum Wage Regulations

The Economic Consequences of Labor Market Regulations

Magna Carta, the Rule of Law, and the Limits on Government

Health Care (a proposal for reform, published in "The Thriving Society: On The Social Conditions of Human Flourishing").

An interview about my views of the relation between economics and history that came out in Politikon (sorry, in Spanish).